Have you heard of Beyond Meat and Impossible Foods? If so, chances are you know a little about the market for meat substitutes and plant-based protein. But what are the prospects for meat substitutes and Plant-Based Meat In China?

Read on to find out what China’s market for plant-based meat looks like today, and where it could lead tomorrow.

Growth Tailwinds for Plant-Based Meat In China

Before getting into some of the tailwinds, it’s worth noting that Chinese cuisine already has a number of meat substitutes, like tofu. Tofu-based foods are already commonly seen at breakfasts, lunches and dinners in China. We think this means the barriers for consumers to accept plant-based proteins are lower in China than other countries.

Indeed, even before the COVID-19 pandemic outbreak, China’s market for meat alternatives was on track for strong growth. Euromonitor, a consultancy, estimated China’s plant-based meat market would grow from around $10 billion in 2018 to nearly $12 billion by 2023.

Now, after the pandemic’s outbreak, a combination of food safety, quality and health concerns will push China’s market for meat alternatives. Here’s a snapshot of why:

- Government Policy: China’s government was already aiming to cut the country’s meat consumption by 50% before the year 2030. Interestingly, preliminary research suggests the population could be open to eating less meat.

- Swine Flu: China has persistent swine flu epidemics. Last year, 40% of China’s hogs died due to swine flu. Flooding this year has damaged efforts to replenish China’s pig population.

- COVID-19 Meat Import Halts: COVID-19 infections at meat processing plants in overseas countries have triggered meat import bans from select countries, such as Germany and the United States.

Combined, these factors will drive increased appetite for changing diet and meat alternatives.

Early Movers for Plant-Based Meat In China

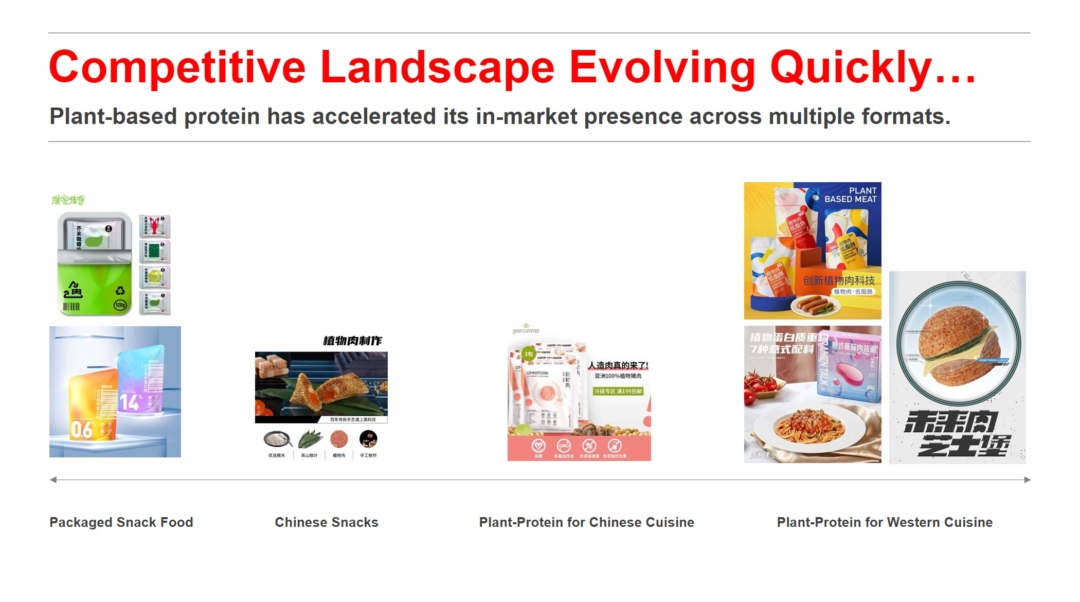

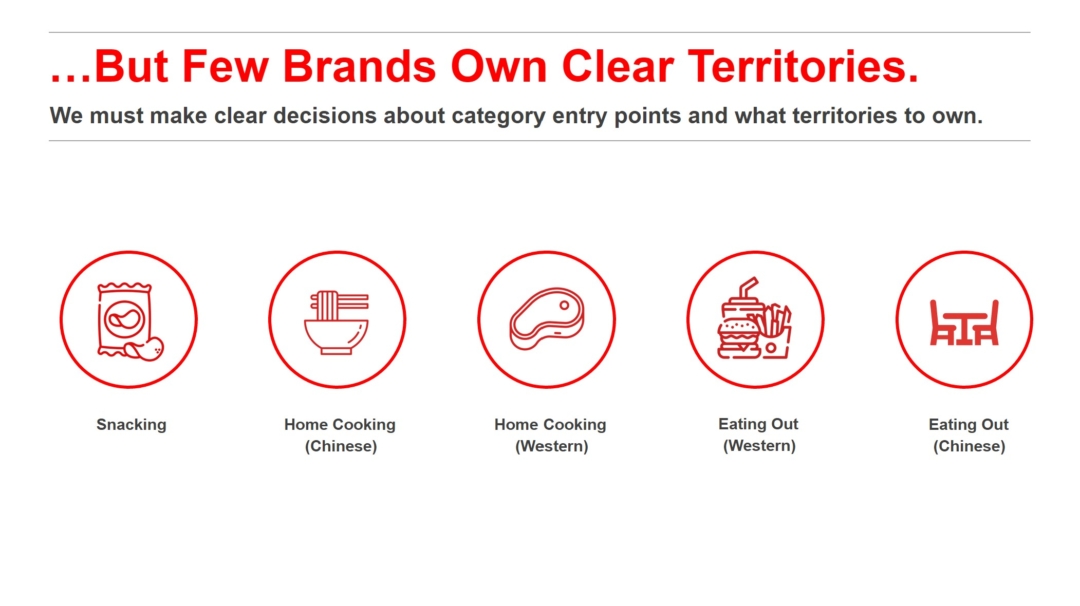

Make no mistake, a race is underway to corner four key segments in China’s plant-based protein market:

- Traditional Chinese snacks (ex.: mooncakes)

- Packaged meat-based snacks (ex.: beef jerky)

- Plant-based protein for Chinese cuisine

- Plant-based protein for Western cuisine

Critically, most domestic players aren’t making burgers and steaks. Instead, they’re instead focusing on local dishes such as dumplings, mooncakes or meatballs, and opting for pork rather than beef flavors.

| Are you looking to find out whether your food or snack brand has a taste profile that works for Chinese consumers? Contact us to see how research solutions like focus groups and product trials might be able to help! |

Both Impossible Foods and Beyond Meat have made a splash in China. Impossible Foods drew long lines and served tens of thousands of samples, including dumplings, meatballs and sliders at China’s International Import Expo last year. After debuting its products with Starbucks, Beyond Meat has partnered with Alibaba-owned supermarket chain Hema to distribute its burger patties to stores in Shanghai, Hangzhou and Beijing.

However, it remains to be seen whether Impossible Foods and Beyond Meat intended to break out of plant-based meat substitutes for Western cooking, or “stay in their lane”.

Having said this, whether domestic or international players, in-market success is far from guaranteed. Companies producing plant-based meat alternatives face three persistent challenges:

- The rate and pace of increasing flexitarian dining habits

- Striking the balance between acceptable taste and an acceptable number of additives

- Ability to compete with other non-meat sources of protein, such as versatile tofu and seafood

Ongoing Themes for Plant-Based Meat In China

Whether pursuing vegetarianism or experimenting with flexitarian dining habits, Chinese consumers will likely have plenty of meatless options to choose from.

What’s particularly interesting about plant-based meat in China is that it marks the intersection of a number of themes in China’s food and beverage market: safety concerns, changing lifestyles and new preferences.

We’ve seen similar themes in functional dairy and sports nutrition. If you’ve got an interesting food or beverage proposition, talk to us.